VIRA Finance

Welcome to Vira Finance.

We have a detailed explanation blog here, where you can find test cases and detailed instructions and a couple of explainer videos.

http://Vira-app.com

In Vira Finance, we are giving you a full technical analysis tool and also a laboratory to test your theories in our environment. ‘Have you ever wished you had more resources to invest in this stock or the other?’ Well, we are not giving you more resources… of course. But we are giving you an environment where you can share intentions to buy or sell stock, and then test against the real performance of the market. We call this feature the Prestige Points. In addition to this new feature we are also giving our traditional tools: MACD and the Vira Finance graph, as well as the Daily Average graph.

WHAT

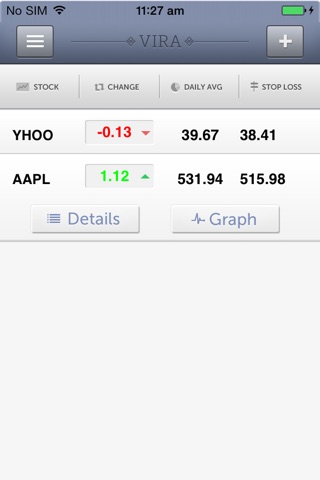

In our app you will find the Portfolio of shares, and the graphics of Daily Average, Vira proprietary graph, as well as Exponential Smoothing Average of the stock price, often known as MACD, and also a Stop Loss calculation and our new feature the Prestige Points.

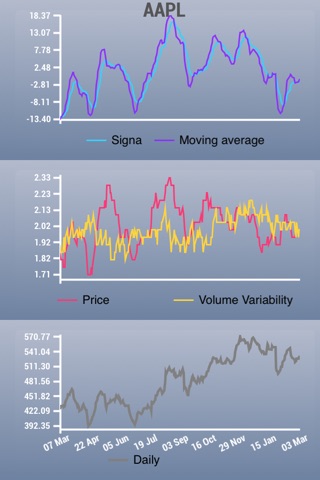

Exponential Moving Average.

This tool is widely used in financial markets and it is associated with what it is known as “Technical Analysis”. So we´ve included it here as a reference. This tool shows two lines, the first on is the difference between two exponential averages (26 days and 12 days), and the second line is the nine day moving average of the first line. According to technical analysts, there is a convergence and divergence in these lines, and these events should be read as changes in the market.

HOW TO

Vira Finance pair of lines

The red line shows the price variability of the stock price, and the yellow one is the variability of the volume of stock traded. The interaction of these two lines indicates momentum in the market.

Look for the extremes:

- The price variability is high, and the volume variability is low: This indicates a momentum in the market in which the price has been high for an unexpected amount of time. This is the sell zone.

- The volume variability is high and the price variability is low: This indicates a momentum in the market in which there has been an unusual amount of shared traded at a low price. This is the buy zone.

And last but not least, introducing Prestige Points!

Our application is your share market laboratory, where you can test your theories and see the results in real-time. We have created a scoring method (Prestige Points) that allow users to assess whether their information and decisions about the stock market are correct.

Sharing of intentions

Sharing an intention triggers Vira Finance to log the current Daily Average Price. All you do is –long press- on the stock you are thinking on buying or selling. You can then choose social media or email if you want to share your intention with friends.

Prestige points

After an intention has been logged, then Vira Finance will calculate Prestige Points based on your ability to predict the movements in the market.

The points are calculated as follows:

If user shares an intention to sell or buy, then Vira Finance notes value in the column ‘Average Daily Price’ P0 for that day, and calculates delta at day P+1,P+2, P+3, P+5, P+8, P+13, P+21.

For example let’s say that shares in VIRACOCHA CORP (yes this is hypothetical) are 100 dollars per share today (to keep it simple)

So at Day 0 (today) I post on Tweeter that I am thinking on buying shares of VIRACOCHA CORP

Then Vira Finance starts running prestige calculations:

Day 0+1 = If price of day 1 is greater than Price A then assign 1 point, if not then 0

Day 0+2 = if price of day 2 is greater than Price A then assign 2 points, if not then 0

etc, until day 21

Same thing, but in reverse if it is I am thinking on selling shares of VIRACOCHA CORP

You can then go to the ‘Prestige Points’ window and –long press- on the points you want to share. Also there is a total Historical points that gives you the total points scored.